20 Pro Suggestions To Picking AI Stock Picker Analysis Sites

20 Pro Suggestions To Picking AI Stock Picker Analysis Sites

Blog Article

Top 10 Tips On How To Assess The Quality Of Data And The Sources For Ai-Powered Stock Analysis And Forecasting Trading Platforms

In order to ensure accuracy and reliability of information, it is crucial to assess the quality of the data sources and AI-driven platforms for trading stocks. Insufficient quality data can result in inaccurate predictions and financial losses. This can lead to suspicion about the platform. Here are the top 10 suggestions to evaluate the quality of data and the sources it comes from.

1. Verify the source of the data

Find out where the data came from: Make sure you make use of reputable and well-known data suppliers.

Transparency. A platform that is transparent should be able to disclose all sources of its data and keep them updated.

Beware of dependencies on a single source: A reliable platform often aggregate data across multiple sources to minimize bias and errors.

2. Assess Data Quality

Real-time data vs. delayed data: Decide if the platform provides real-time data or delayed data. Real-time data is essential for active trading, while delayed data is sufficient to provide long-term analysis.

Be sure to check the frequency of updates (e.g. minute-by-minute updates or hourly updates, daily updates).

Historical data accuracy: Ensure the accuracy of historical data and that it is free of anomalies or gaps.

3. Evaluate Data Completeness

Look for data that is missing. Look for gaps in the historical data, missing tickers or financial statements that aren't complete.

Coverage: Make sure the platform provides a broad variety of markets, stocks, indices and equities relevant to the strategies you use for trading.

Corporate actions - Check if the platform account stocks splits. Dividends. mergers.

4. The accuracy of test data

Cross-verify your data: Check the data of your platform against other trustworthy sources.

Error detection - Look for outliers, incorrect prices or financial metrics that aren't in line with.

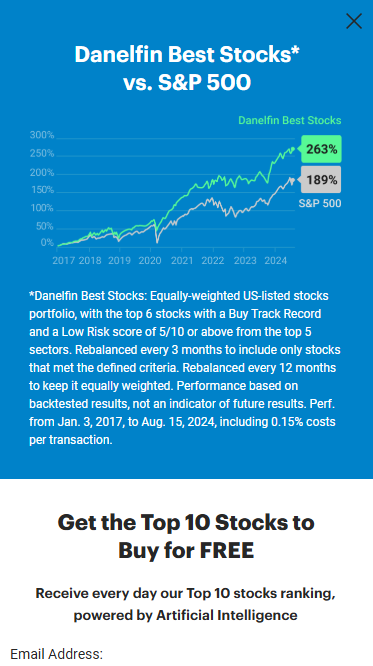

Backtesting. You can test strategies by using data from the past and then compare the results with what you expected.

5. Review the data's Granularity

The platform must provide detailed data, such as intraday price volumes, volumes, bid-ask as well as depth of order books.

Financial metrics: Make sure the platform provides complete financial statements, such as the income statement, balance sheet and cash flow. Also, make sure it includes key ratios like P/E (P/B), ROE (return on equity) etc. ).

6. Make sure that you are checking for data cleaning and Preprocessing

Normalization of data: Ensure that the platform normalizes data (e.g., adjusting for splits, dividends) to maintain consistency.

Outlier handling - Check out the way your platform handles anomalies or data that's outliers.

Missing data estimation: Verify that the platform is based on reliable methods to fill in the missing data.

7. Verify data consistency

Data alignment to the correct time zone. To prevent discrepancies ensure that the data in all files is synced with one another.

Format consistency: Verify that the data has been presented consistently (e.g. units, currency).

Verify that the data is consistent across markets: Check for consistency from different exchanges and/or markets.

8. Determine the relevancy of data

Relevance of the data to your trading strategy: Make sure the data you collect is in line to your trading style.

Selecting Features: Check whether the platform offers relevant features, such as sentiment analysis, economic indicators as well as news data which will improve the accuracy of the accuracy of your predictions.

Examine data security and integrity

Data encryption: Verify that the platform protects data when it is transmitted and stored.

Tamper-proofing (proof against tampering): Check to make sure that the data has not been altered or manipulated by the computer.

Check for compliance: The platform should comply with the data protection regulations.

10. Transparency of the AI Model of the Platform is Tested

Explainability. Make sure you can be aware of how the AI uses data to make predictions.

Examine for detection of bias. The platform should continuously detect and correct any biases within the model or data.

Performance metrics: To assess the reliability and accuracy of predictions, examine the platform's performance metrics (e.g. precision, accuracy recall, accuracy).

Bonus Tips

Reviews and reputation of users Review user feedback and reviews to gauge the credibility of the platform as well as its data quality.

Trial period: Try the platform free of charge to check out how it functions and what features are available before committing.

Support for customers: Ensure that the platform provides robust support for data-related problems.

By following these tips, you can better assess the accuracy of data and the sources of AI platform for stock predictions to ensure you take informed and reliable trading decisions. Have a look at the top ai stock trading bot free for blog info including best ai stock trading bot free, ai trading tools, using ai to trade stocks, ai stock, ai for stock predictions, ai investing platform, ai stock trading bot free, market ai, ai stock trading app, ai stock trading app and more.

Top 10 Suggestions For Evaluating The Community And Social Capabilities Of Ai Stock Trading Platforms

To better understand how people learn, interact and share their knowledge among themselves, it's important to evaluate the social and community-based features of AI trading and stock prediction platforms. These features can greatly enhance the user experience and offer valuable assistance. These are the top 10 tips to assess social and community aspects on such platforms.

1. Active User Communities

Tip: Look for a platform that has an extensive user base that regularly participates in discussion, provides insights and feedback.

Why: An active user community represents a lively ecosystem in which users can learn from each other and grow together.

2. Discussion Forums, Boards

TIP: Check the quality and level of participation on message boards or forums.

Why Forums are important: They allow users to discuss strategies, ask questions and share market trends.

3. Social Media Integration

Tip Check to see if your platform integrates with other social media platforms such as Twitter and LinkedIn to share news and information.

Why social media integration can boost engagement and give current market updates in real time.

4. User-Generated content

TIP: Find tools that let users create and share content for example, blogs, articles or trading strategies.

Why: User-generated material fosters collaboration, and it provides various perspectives.

5. Expert Contributions

Tip: Check if the platform has contributions from experts from the industry for example, market analysts or AI specialists.

Expert opinion adds the depth and credibility of community discussions.

6. Chat and Real-Time Messaging

Check if there are any instant messaging or chat options which allow users to chat immediately.

Why: Real-time communication facilitates rapid information exchange and collaboration.

7. Community Moderation and Support

Tips Assess the degree of the moderation and customer service in the community.

Why: Moderation is important for maintaining a positive, respectful atmosphere. Support is available to help users resolve their issues as quickly as possible.

8. Webinars and events

Tip - Check to see whether the platform allows live Q&A sessions with experts, webinars and events.

The reason: These conferences offer professionals from the industry with an opportunity to interact with attendees and learn from them.

9. User Reviews and Comments

Find options that give users the ability to provide feedback and comments on the platform or the community functions it offers.

Why: User feedback is used to identify strengths and areas for improvement within the community ecosystem.

10. Gamification and Rewards

Tip - Check to see whether your platform supports gamification (e.g. badges, leaderboards) or rewards given in exchange for participation.

Gamification can motivate users to become more involved with the platform and community.

Bonus Tip: Privacy & Security

To protect the data of users as well as their activities, make sure that community and social features are protected by secure privacy and security controls.

You can evaluate these features to find out whether the AI trading and stock prediction platform provides a community that is supportive and encourages you to trade. View the best how to use ai for copyright trading recommendations for site info including chart ai trading, ai for trading stocks, ai trading tool, ai stock price prediction, ai stock trader, invest ai, best ai stock prediction, best ai stocks, ai stock analysis, ai copyright signals and more.